Why, Whether Trekking Or Trading, You’d Better Know Your Ticks

That knee-jerk reaction of a shot of panic when we see a tick crawling up our leg is nearly universal. We want it off and we want it off right now!

Not all of them are seriously dangerous. However, some carry acute diseases that can make us very ill. Every one we see deserves and gets our immediate attention and action.

There are ticks in the markets as well. Each trade executed counts as a tick. Some ticks in the market can have much more of an impact on your trading accounts than others.

It can be difficult to tell live ticks apart. The only safe thing is to treat them all as dangerous. With live ticks, knowing which ones are really dangerous can be tricky and require close examination.

In the market, there are too many ticks taking place to deal with all of them. But, we have tools available that allow us to spot the ones that can affect our trading accounts.

Market ticks are really only dangerous to traders when we don’t understand what they are and what they are not. Misunderstood risks are the ones that bite our portfolios where we don’t usually look. Then they just suck the blood out of our trading accounts and leave them sick and weakened.

What Makes One Tick More Important Than Another?

Just like ticks in the woods, market ticks can seem impossible to tell apart. However, every order isn’t the same when you look at the details.

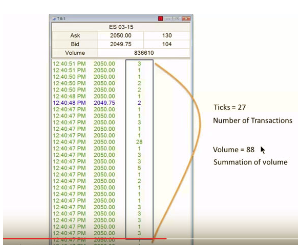

With market ticks, it doesn’t matter how many contracts traded in a particular order — it is still one tick! That’s right, an order for 28 contracts is one tick. An order for one contract is one tick

The number of ticks doesn’t tell us much. It’s just those big, fat institutional ticks we need to watch. Those are the ones that will drain the blood from our trading accounts in a hurry.

The institutional money creates the ticks that can inflict damage or benefits on our accounts. Successful traders have to know where they are and where they are going.

Technology allows us to spot the ticks that are meaningful and not waste time on the little ones that can’t hurt us.

How Can You Possibly Review Every Tick?

You can’t — and you don’t need to.

Tools like the order flow sequence tracker, available in some of the better trading software packages, compile and display the tick information for us. We can see it all at a glance. It also allows us to view the summation of this information through a tick chart over volume.

This format allows us to compare the number of ticks to the total number of contracts traded in a specified set of bars.

The Tick Over Volume Chart allows traders to spot areas of potential interest based on the relationship of ticks to contract volume.

Your trading account won’t even make a morning snack for the institutional blood suckers. Now you can spot them fast — and you need to.

Don’t think just because the institutional ticks are big and fat that they are slow. These guys will jump on your account faster than a deer tick on a bird dog on a hound dog. The areas where contract volume significantly outpaces tick volume will indicate the larger trades carried out by the institutions.

Don’t Let The Institutional Market Ticks Drain Your Trading Account

So how do you use ticks and volume to your benefit?

Overlooking the wrong tick in the woods can make you pretty sick. Overlooking an important tick in the market can send your trading account (or others) to the hospital.

The institutional money in the market will create the big, fat, important ticks filled with the funds of unwary traders. The tick volume indicator will point them out to you just as clear as day. You won’t even need to be an entomologist to spot them.

Step number one is to keep those institutional money suckers off of your trading account. The tick volume shows you where they are.

The next step is to follow the lead of the biggest, fattest ticks and let your trading account be the little tick moving that lives off the leftovers. After all, sometimes the leftovers can be pretty darn tasty!