Why Used Car Salesmen And Professional Traders Prefer Customers Who Don’t Know Fair Value

“Trust me. It’s a fair price!”

You know as well as I do that the used car salesperson who feeds you that line will lie to you about other things as well. When buying used cars, everyone knows that the rule of the day is “buyer beware”.

Futures trading is a lot like used car buying. There are times when the market will tell you some pretty tall tales regarding the “fair value” of an asset. You are the one expected to know the truth and make sure you don’t get ripped off by the slick salesperson.

Why Is Fair Value Important?

Preparing to buy a car? Everyone knows they need to do some research to determine the fair market value before making a deal. Some car salesmen will take advantage of unwary buyers. Yep, I know it is hard to believe, but it is what they say.

The institutional and professional traders in the futures markets can be a lot like car salesmen when you think about it. Their job is to get the best price on their buy or sell orders. It’s not to assure you are treated fairly.

It is up to you to make sure you do not overpay for an asset, or take less than you should when you sell one. Every dollar you don’t make is a dollar the other side does.

If you don’t know the fair value of the assets you are trading, do you expect the other party to tell you? Really?

The Search For Fair Value

It doesn’t matter if the asset is a used car or a futures contract. The fair value of any asset is determined by the price range within which the heaviest volume of business occurs.

If you are trying to find out the fair value of a car it is easy. You hop on the Internet and type in the year and model that interests you and… voila! More information than you could look at in a month. It is easy to find the asking prices of used cars. It is more difficult to find out the prices at which they actually sell.

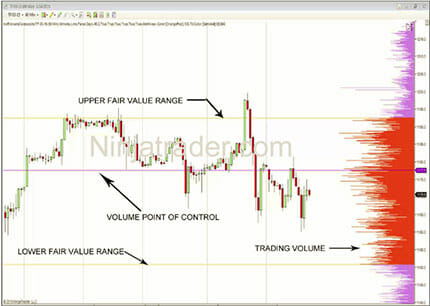

Finding fair value of an asset in the futures market is actually easier. Some trading software provides tools that display a range of fair market value for you.

Use Fair Value To Increase Your Profits Instead of the Professionals’

The fair value of an asset is the price range at which the heaviest volume of contracts changes hands. Prices above or below this level signal opportunity for traders.

This chart allows small traders to see exactly where the fair market price should be compared to the current price. Once you are armed with this information you know exactly when it is better to buy or sell.

Isn’t The Market Always Efficiently Priced To Reflect Fair Value?

This is so much easier than trying to find the fair price of a car. All you get there are asking prices. The use of actual transactions around the heaviest volume shows traders exactly how to buy low and sell high.

Prices in the futures market are just as fair as those you find in the car business. If you haven’t done your homework, hold onto your wallet!

Current prices in the futures market are established by supply and demand volumes surrounding a particular asset. The frenzied buying and selling that takes place in the market constantly results in mispriced situations.

Just like car salesmen, the professional traders are quite happy to take advantage of uninformed customers.

It’s Not Hard To Get Started

Now, you don’t have to be one of those uninformed customers anymore. The market price is going to gravitate around the real fair value of the underlying asset. Technology now makes it easy to see when you should buy low and sell high.

The market can stray much further from fair value than most people realize. Always be sure to wait for a new directional trend to establish itself before jumping in.

When the price is well below fair value and heading higher, you buy. When the price is well above fair value and heading lower, you sell. When the price is at fair value, you wait.

Car salesmen and other traders will lie to you about fair value. They want you to buy and sell based on excitement and fear. Using actual market fair value to determine when to enter and exit positions will greatly enhance your trading results.