Spotting A Two Million Dollar Value For Less Than 5 Dollars

Imagine the thoughts racing through Andy Fields’s mind when he saw a $5 price tag slapped on an original Andy Warhol sketch at a garage sale — a sketch valued at $1.9 million.

Do you think he struggled to keep a straight face when he made his offer?

Clearly he understood the same two ingredients a trader needs when making a winning trade: knowing the value range and spotting a pricing extreme.

Likewise, understanding the value zone can help you find bargain trades, in futures and beyond, that do the same.

Establishing the value range helps you avoid the sucker’s price

Fields probably couldn’t guess the exact price Warhol’s sketch would fetch, but he sure as hell knew he’d be selling closer to the actual value range.

Likewise, periods of high volume and consolidation establish value ranges that can be used as guides to profitable trades. Accurately defining these ranges will help you spot opportunities when they’re challenged.

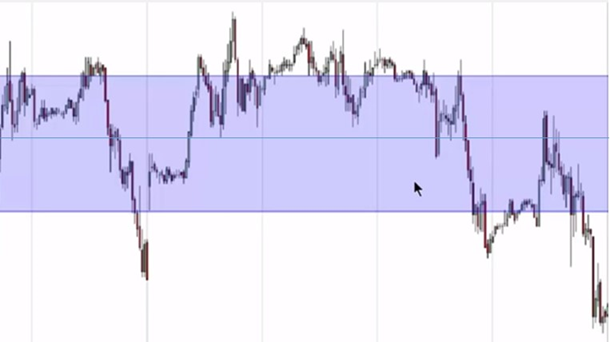

Note the established value range above, as the market grinds along, consolidating and fluctuating with demand. While some of these fluctuations are tempting, trading in the middle of this range means you’re paying fair price.

This would be the equivalent of showing up at the auction, fighting with every other player to pay top dollar for Andy’s find. Exactly what the institutions are hoping for.

Spotting the bargains that stray from fair value

Lost pieces of artwork are scooped up at rummage sales and estate auctions with alarming frequency by buyers in the know. They understand not just the value, but the demand that supports it.

With futures, and just about anything else, extreme movements in value are also driven by demand. In this case demand is being created by real people sitting on the other side with a vested interest and a position to protect. Likely misinformed, it’s their collective reaction to demand that pulls them away from fair value.

Increased volume is your first indication that demand is being stressed, and that demand is starting to push price away from the zone.

When pricing actually breaks out of the value zone, this is confirmation that we’re reaching an extreme. Your goal is to spot prices that leave the zone on either side. Breaks into value high, just above the zone, present chances to short. Alternatively entries into the value low are natural targets for a long position.

Once you’ve snatched your Warhol, get ready to head for the auction at Christie’s where fair value will reign.

Why your retail indicators miss the real steals

Without a doubt, there are countless indicators out there designed to define pricing range — each claiming to help you spot extremes.

Unless you’re willing to set your high and low bands beyond generally accepted parameters, you will likely miss capturing the entire value range. This leads many into the trap of believing fluctuations within fair price are good deals.

Establishing the value range requires taking a step back and seeing the entire market before you. This will reveal true extremes and safeguard you from everyone’s fear with this trading strategy — a breakout.

Priceless paintings are often validated by viewing the edges of the canvas — photographed for insurance purposes. Likewise, the edges of value highs and lows should be considered when making your entry. Edges showing fatigue with long wicks are signals that force of the value area is taking charge. Solid candles barreling through the edge could be signs of a breakout.

Either can be spotted with a full view of an established value zone. Both will be likely missed or revealed when it’s too late with your standard retail indicator.

Factoring in fair value when eyeing the entry

Nabbing a trade at a pricing extreme positions you to profit when price is reeled back into the value zone. As usual, the institutions eventually take control of the extreme with their massive positions — driving everyone back to fair price.

As this happens, your competition is likely glued to their indicators scrambling to make sense of the fluctuation and the direction of price. Meanwhile, you’re enjoying the swagger back to the grinding auction of consolidation.

Given the volume likely taking place closer to fair price, you’ll have your pick among the retail suckers willing to pay the price you avoided.

Commanding more profit in a packed marketplace

Andy Warhol’s top 10 painting sales have hauled a combined $760 million with a value zone that ranges from $105.4 million to $38.6 million (which was incidentally the famous Four Marilyns). Just like the pricing you evaluate with futures, their value was established over time and the price driven by fluctuations in demand.

Don’t grind along with the masses, falling for the sucker price the pros are setting within the value range. Step back and see consolidation for what it is — the safety zone of fair price for the institutions — and your boundaries for entry.

Look for extremes that break into value highs and lows of the established zone. Make your move as momentum for the pricing challenge shows signs of fading within that extreme. Plan for the price to be pulled back in by the institutional force of fair price.

Be wary of volume and prices that barrel through the edges of any zone without signs of letup — as the market may be seeking a new range.

Keep a straight face when you profit while everyone else reels.