Keep Your Account From Blowing Up With Advanced Trading Strategy (ATM)

During the height of the Cold War, the deep waters of the North Atlantic were home to some of the deadliest games of cat and mouse. Nuclear submarine commanders held the fate of the world in their hands every time they encountered potential conflict.

Any time conflict was contemplated, strict adherence to safety protocols ensured a misfire didn’t unnecessarily complicate already tense circumstances. This was especially the case when dealing with torpedoes. The survival of the crew, the ship and countries at home hung in the balance.

While the stakes might not be quite as high, safety protocols when dealing with your trades will save your account from disaster. You can easily bring your risk management plan to every chart with one simple click.

A way to bring your risk tolerance to life in your trades

As you can imagine, safety is paramount when operating on an enclosed vessel that’s about 300 feet long, 30 feet wide and three stories in height. Especially when you’re below the surface of the ocean at depths of 1,000 feet or more.

With little to no margin for error – mishaps must be avoided at all costs. The same is true when implementing your risk management plan into your trading strategy.

Start by confirming your acceptable risk / reward ratio – how much you’re willing to put into a trade and how much you expect to get out. For scalp traders, a small risk / reward ratio is often more acceptable, given the frequency of trades and the short amount of time in the market. With a smaller tolerance for loss – the ratio will be in the neighborhood of 1:1 or 1:2. Swing traders will be more aggressive with a 1:3 or 1:4 ratio with more room to absorb losses.

Once your ratio is determined, the ATM (Advanced Trade Management) strategy will help ensure you honor this commitment with every trade. This feature in NinjaTrader allows you to automatically insert stops and targets once an order is filled.

Doing so helps you avert catastrophic loss should price go against you.

Seamlessly manage risk within every trade

You can’t walk five feet in a nuclear sub without seeing safety precautions, alerts and reminders along the way. Nowhere is this more evident than when you’re near the reactor or the weapons.

In the case of ATM, it’s right in front of you on your chart trader console. You start by adding your chosen ratio(s) as custom ATM strategies within NinjaTrader. It takes less than a minute to complete, and in that time you’ve ensured that losses can be contained within your risk management plan.

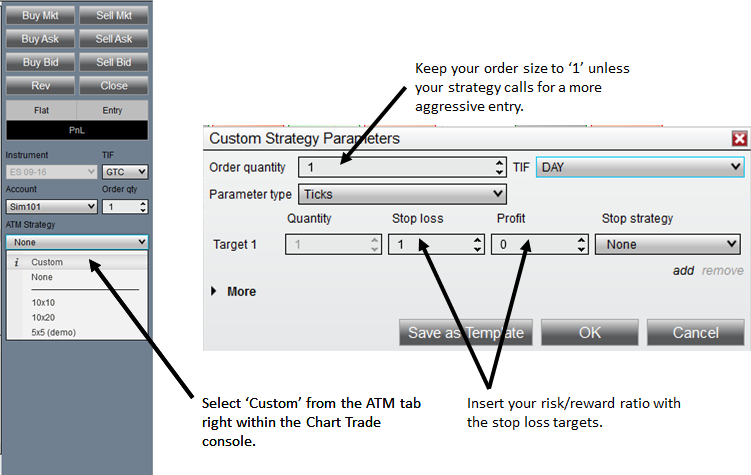

Say you’re scalping a particular session, operating with a 1:2 ratio. Simply click on the ATM tab within your chart trader and select ‘Custom’. When the window comes up, you’ll quickly be able to:

- Select your standard order size – usually kept at one – unless your strategy calls for taking multiple contracts.

- Determine TIF (Time in Force) – which sets how long the ATM will be in effect. Daily usually works just fine.

- Insert your stop and your target, using ticks as your unit of measurement.

- Add a custom Stop Strategy – if you’re interested in a rolling stop loss. Keeping this static with ‘None’ as your selection is a good way to keep your decisions simple and manage your trade accordingly.

With these settings in place, you’re ready to manage risk and contain damage with every trade.

Dynamically keep your trades safe from disaster

Containment is the number one priority if there’s a fire or explosion on any ship. Many submarines are designed to seal off portions of the vessel to make sure the emergency doesn’t spread.

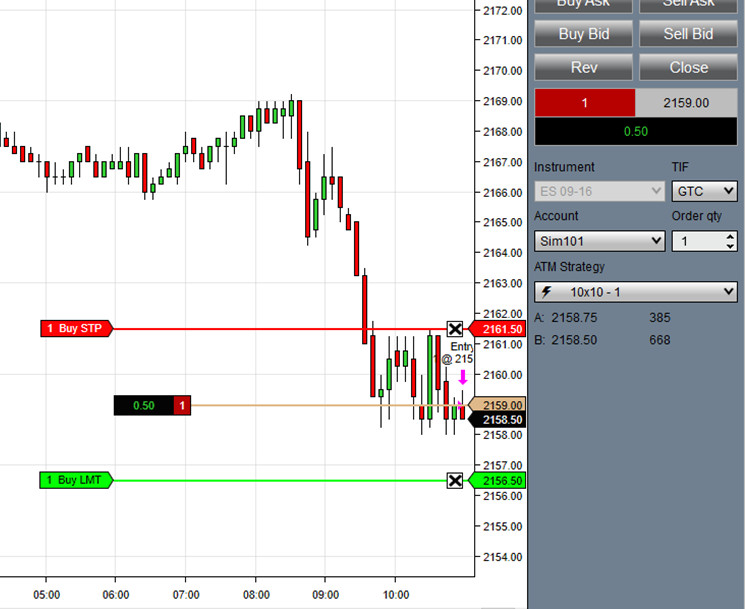

ATM operates much the same way. Once your order is filled, your stop loss and profit targets are immediately in place. Depending on how you choose to manage your trade and exit – you know that the final fail safe is in place if things go seriously against you.

While you can adjust the targets, the very act of doing so forces you to make a decision: ‘Am I following my risk management plan?’ For many traders this is the moment of truth. Are you opening yourself up to more risk because you know what the outcome will be – or are you hoping that price will come back in your favor?

If you treat your account like the precious vessel that it is, you’ll err on the side of containing the risk and limiting your losses to sail another day.

Avoid unforeseen conditions that sink the ship

According to the Navy it takes a full year of training to become qualified to even set foot on a submarine in active duty. The bar is pretty high and the process is grueling – only fit for a chosen few. The process is called earning your ‘Dolphins’.

Many argue that their trades need room to breathe and that different market circumstances require ‘on-the-spot’ calls to be made. Experienced traders who have earned their ‘Dolphins’ will tell you that this is a great way to clear out your account.

If you’ve entered into a trade and it doesn’t work out – get out. Honor the stops that you agreed to in the first place. In the end you’ll be thankful for a tool like ATM that’s served as the final guardrail before heading over a cliff.

No more is this the case than when encountering unforeseen events – like news – that can swing price against you in a matter of seconds. All it takes is an announcement from a central bank or a talking head on TV to send price against you – and well past your acceptable loss limits.

Keep the safeties on and live to fight with another trade

In the end, the Russian sub commander chasing Marco Ramius in Hunt for Red October was done in by removing the safeties from his torpedoes. His own torpedo circled back to blow his sub up. ‘You’ve killed us all…’ was the final word from his number two.

Don’t take unnecessary risks with your trading account. Pre-set your custom ATM strategies in NinjaTrader in a matter of minutes. Implement ATM on every trade simply by having it pre-selected and ready to roll with every entry. Tie the settings directly to your risk management plan.

When you take your entry – honor the stop and target that reflects your desired risk / reward ratio for that trade. Know that removing the stops or failing to use ATM can leave your account open to catastrophic loss – effectively a torpedo trade – that comes back to do you in.