Add Nitro To Your Account By Trading With Volume

The ‘strip’ at Las Vegas Motor Speedway. You’re strapped into your top fuel dragster, hands at 10 and 2 waiting for the light to change. Don’t blink. You’re in the fastest-accelerating racing vehicle in the world. The fastest racers reach speeds of 335 miles per hour and it will all be over in less than four seconds.

It’s not just any fuel that’s racing through the semi-truck-sized engine mounted inches behind your head – it’s nitro. Regular gas will only burn so much with each stroke of the piston – nitro will give you almost 10 times more burn, which equates directly into raw power.

In the drag race of the market, you can add nitro to your trades, simply by keeping an eye on volatility and volume. Pointed in the right direction, with a steady hand on the wheel, and you’ll get results that beat out regular retail traders.

The accelerant you’re looking for

Why add nitro? Simple… it makes you go really, really fast – which, if you happen to be in a race, can come in really handy. If it’s been keeping you up at night, you might care to know that the average sports car will give you 25,000 – 37,000 rpm. A nitro engine will turn in excess of 50,000 rpm. Fast enough to set your hair on fire if you’re not careful.

In any given market, there’s gas for the moped, gas for the station wagon and finally gas for the race car. You simply need to watch volume to know exactly what you’re dealing with and how fast the market will go in any given direction.

You can harness this power to put extra juice behind your trades, or you can plod along in the bicycle lane – helmet strapped to your head – hoping the institutions don’t run you off the road. The key is to understand what direction the fuel is driving the market – and making sure you’re on the right side of the trend.

An easy gauge that tells you when it’s ‘go time’

Before making their run, Top Fuel racers will often perform a ‘burnout’ in order to clean and heat their tires. Don’t try this at home – since this usually will apply a fresh layer of rubber to the road. In the case of a drag race, this greatly improves traction when the light turns green and it’s time to launch.

Like a freshly ‘burned’ track, the market lays fresh rubber for you to get traction with in the form of volume. You can monitor it simply by monitoring volume at the bottom of your chart. Available in just about every futures market and on every trading platform – volume oscillators tell you when the action is going down.

Volume also allows you to keep an eye on the busiest trading periods during the day – when you’ll likely see your biggest, most pronounced price swings. Consider it to be the market equivalent of watching the ‘Christmas Tree’ lights at the strip – going from red to green, telling you when to get ready to hit the gas.

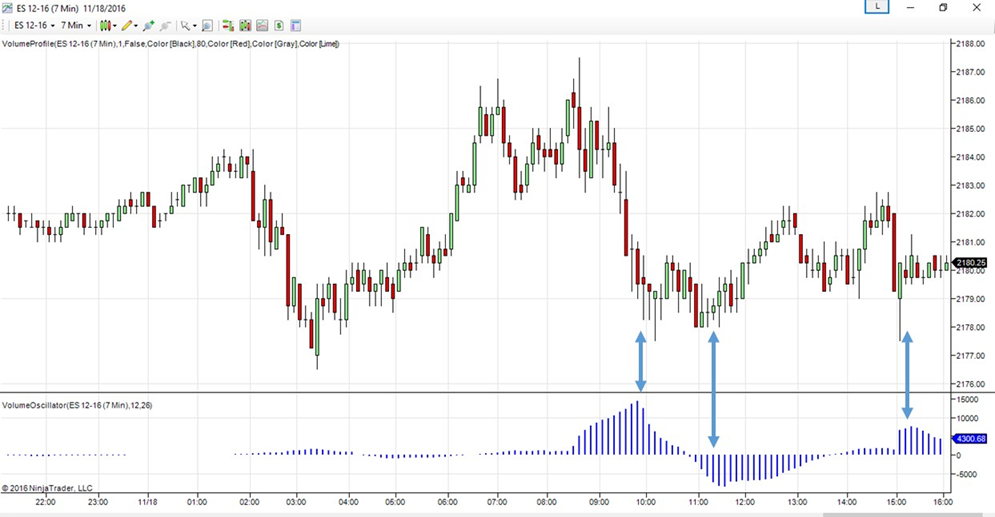

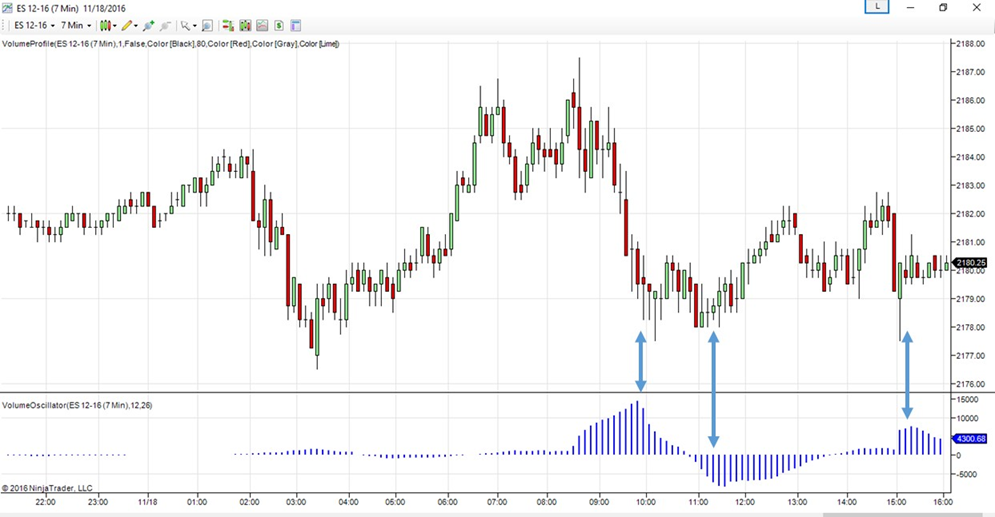

Check out the volume oscillator in the ES chart here. Pretty much impossible to miss when all the action went down over the course of the day – and how it coincided with the pronounced trends to watch for.

Reacting to entry opportunities at market speeds

They say it’s reaction time followed by raw acceleration – whoever can get their foot on the gas first combined with the engine that can burn the hottest. It doesn’t last long, but it makes for a very entertaining stretch of road – since the force into your face is in the neighborhood of 5 Gs.

When taking on price in a head-to-head race, you just need to watch direction and velocity to best understand where to understand pressure. Once you see a pronounced price run in a direction, prepare to make your entry with volume as the move is made.

Note our ES example here. After the open, as volume ramped up towards 9am, you can see volume steadily increase as price makes its move. When volume finally starts to taper, you see that the market found its bottom right around 11am. An excellent gauge for an entry – and then ultimately an exit.

Avoiding a crash by sticking to your principles

The action that comes with racing brings with it the requisite danger. It’s what keeps most people away – both from behind the wheel and off the drag strip. There’s been more than one crash that finds its way into YouTube infamy.

Likewise, when the market is on the run, many traders steer clear of high-volume, high-volatility timeframes, not wanting to get burned. The rationale being – when things are moving that fast it creates more risk than opportunity.

Trading during periods of high volume should only be done in conjunction with your other established disciplines. The principles of trading at pricing extremes at the edges of value still very much apply. Waiting on established support and resistance levels are still critical. Volume just helps accelerate your chosen entry once you’ve decided to hit the gas and enter.

Blow by your targets when you hit the gas

The current king of top fuel drag racing is widely regarded to be Larry Dixon – a three-time NHRA champion. His father raced – and to hear him talk, he has nitro running through his veins. He is said to have a perfect reaction time of .5 seconds – from when the ‘Christmas Tree’ changes from red, to yellow, to green.

Fortunately you have far more than half a second to respond when using volume as a guide during periods of high volatility. Simply track market volume on your chart, having it coincide with your exact time frame. When you see sustained volume over 1,000 for the ES, you know that you’re cooking with gas. Over 2,000 and nitro is being injected into the system.

As price gets ready to burn some rubber, make your entry and trade with the overwhelming volume. Go ahead, do a few donuts on the middle infield when you win.