You don’t need to see the car to know it’s incredibly fast. In fact the name says it all – Formula 1.

By the time it rolls onto the track, an average of $6.8 million has been spent on an F1 car. In fact, there are around 80,000 components working together – all of which need to work with 100% accuracy to stand a chance. The days of Herbie are long forgotten the second one of these mechanical wonders fires up the engine.

Whether you believe it or not, there is an F1-like strategy sitting right under the hood of your trading platform – and it won’t cost you a cent. In the never-ending race of today’s currency markets – this can be the difference between a losing entry and consistent success.

You just need to know what to look for, and how to manage this index with your trading strategy.

All the trade location horsepower you can hope for

If you’re behind the wheel of an F1 race car and decide to floor it, you can expect to experience up to 5Gs in force when trying to break or take a corner. That’s a force that’s usually five times the driver’s own bodyweight.

Who needs to know about horsepower or cubic engine size when dealing with that kind of power! Zero to 100? It can reach 100 miles per hour and decelerate back to ZERO in just four seconds.

If you’re interested in trying to understand the speed that’s driving the market, you can take a 4-second glance at the Money Flow Index. Instead of the 80,000 different parts that make up an F1 racer – this will require only one addition to your chart.

This oscillator uses both price and volume to determine buying and selling pressure in any given market. Created by Gene Quone and Avrum Soudack, this is a great compliment to the RSI in that it’s volume-weighted.

Using a range between zero and one hundred – this index will tell you the momentum to watch for when identifying reversals and price extremes. Once you start verifying your trades with Money Flow, you’ll likely never look in the rear view mirror.

It’s just a matter of watching for the right conditions.

Trade with the prevailing force, not against it

It’s a little known fact (cue Cliff Clavin)… that small planes can take off at slower speeds than F1 cars race on a track. The only thing standing between the car and takeoff? Physics and an aerodynamic design that creates enough downforce to keep it on the ground.

Since there’s nothing that will keep the market on the ground, MFI (Money Flow Index) can tell you exactly where the market stands – as buying and selling forces do battle. To determine this, you’re specifically looking at the edges of the index for buying and selling pressure extremes.

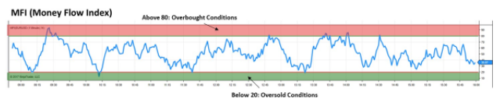

Since the index operates with a range of zero to 100 – you’ll want to keep an eye on conditions above 80 and below 20. Above 80 and the buyers have lifted price towards the heavens a bit too much. Below 20 and the sellers are dragging it down too far for the market’s taste.

It’s these moments that you’re waiting on for an entry. The very instant when buyers have about had enough – are starting to run out of gas and the sellers are looking to step in. And vice versa on the other side.

Here is what the MFI looks like. Like a speedometer for the market, you can quickly see when market conditions reach extremes.

An immediate way to know where the institutions are headed

Amazingly enough, an F1 car engine doesn’t run forever. In fact, they only run for about 2 hours of racing – before pretty much blowing up. The car in your garage? We usually expect those to last for at least 20 years – if not much longer. That’s the extent to which an F1 engine is pushed.

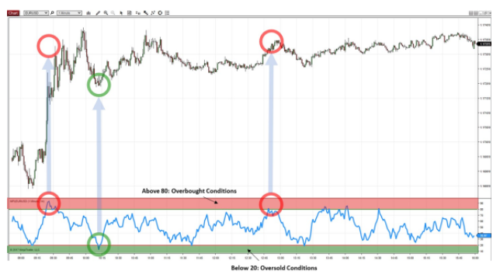

Like an F1 engine, when the market gets pushed to its limit – you have a chance to enter for a profit. When the MFI is pegged in either direction – watch for an entry opportunity. To confirm the entry you’re looking for responding pressure from buyers or sellers coming in to push the swing.

Staying with your same EUR/USD MFI, note the relationship between the breaches in the index and big swings with this currency pair. They don’t come every minute of the trading day, but when they do – there are plenty of pips to go around.

Keep in mind that, like any market – there are high and low volume periods. You want to be trading during the cash session where volume will be there to support the market move to get the most out of MFI.

Leave the moped entries to the rest of the retail trading public. Enter with the speed and force of MFI and bring F1 glory to your account.