eBook – The Scalpers Edge

Chapter 1:

The biggest hoax in scalp trading.

Why watching price is a waste of time.

It’s Christmas. Otherwise known as hunting season.

Every day they can see them coming from a mile away.

Tourists. Easy money.

No, we’re not talking about an exotic market in some remote village. We’re talking about the sidewalk between West 53rd and 56th streets in Manhattan.

It’s happening in plain sight. The age-old hustle: the crooked card or shell games.

One by one tourists are lured in by the prospects of easy money as season hustlers reel them. You’d think this is a thing of the past. Left for the movies. By now everyone knows right?

Not so. In fact, it seems so easy. Just watch the shell and take your winnings, right? Nope. In fact, never. In a matter of seconds, hundreds of dollars are lost and a ghost white dude from Iowa is staggering away while his wife is still asking ‘what just happened?’.

Welcome to New York, sucker. Oh, it’s Christmas? Who cares. To the locals that walk the streets every day, the scam is just another part of life.

Mere blocks away, another hustle is taking place – on Wall Street. Millions and millions of traders sit in their living room or office and unknowingly walk straight into the same trap every second the market is open.

Sidewalk shells have been replaced for an illusion that’s far more effective: price.

The very thing that every retail trader can take his or her eyes off. And the exact element that the institutional sharks completely ignore. It’s a hoax.

Why is price so enticing? Simple – it’s the score by which profits, and losses are determined. Who wouldn’t want to be fixated by it?

Why is it such a trap? Even simpler – it’s not what drives the market. Not even close.

If you’re in the market, scalp trading amongst the massive institutions that drive it, you face a simple choice: Trade with them and profit. Or trade against them and be fleeced. How quickly either happens is entirely up to you.

Trading with them and consistently profiting requires that you pay attention to the one clue they give you. And by clue, we’re talking about a sledge hammer. You must know what to look for.

Chapter 2:

A Market Force That You Can’t Ignore

Escape that treacherous sidewalk, or even the pitfalls of Wall Street for just a moment. Hop a cab with us to LGA (LaGuardia Airport). Here you’ll find the perfect example of the market force we’re talking about.

In fact, you can’t miss it, unless you’re blind, deaf and have no sense of feeling. When a jumbo jet takes off, the ground shakes as the atmosphere submits to this massive aircraft’s will. An Antonov 225 six enormous turbofan engines lifting it off the ground sound like

they’re laughing at God as they’re pushed to full throttle.

Attempting to take off right behind the 225 in a small puddle jumper is a death wish, given the jet wash this behemoth leaves behind. Yet that’s exactly what millions of retail traders do every day when making their entries and exits in the face of institutional 225-like moves.

Think of it as a shell game with just a wee bit of thrust behind it. Enough to clear your retirement account.

Fortunately, there’s a way to get inside huge institutional liftoffs before they taxi to the runway. This can be done by monitoring the very fuel powering their moves.

That one thing it comes down to? Volume.

Most retail traders have no idea what institutional volume they’re dealing with when entering their trade. After they’re blown away when it takes off, they’re left to pick themselves up – and what’s left of their account.

If you’re watching volume properly however, you have amazing opportunity to enter alongside institutional traders and profit. Why? Because it’s what accounts for the major trends and reversals in the market.

This can be done with one fundamental practice: Volume Spread Analysis.

Often overlooked or even misunderstood, this as been an effective method for identifying entries for well over 100 years.

Let’s put it this way. If they could do it with ticker tape back in the days of the Titanic… we’re pretty sure you can do it today with your PC.

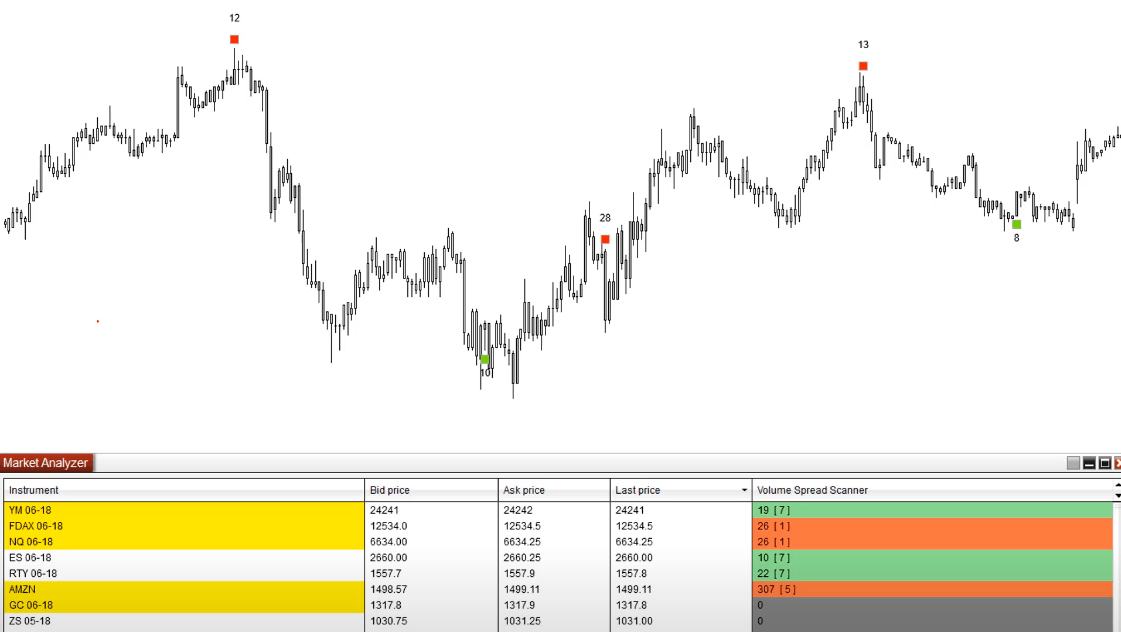

Now that you know where to look, and what to scan for – let’s see our new found perspective in action. And by ‘in action’ we’re talking about one thing: daily profits.

Chapter 3:

A Simple Way To Spot Price Moves (In Any Market)

Imagine being able to spot massive price moves when they’re in the very early stages of making their move. Not chop, or minor fluctuation. Massive breaks in the dam of the market. When the real money gets made.

Here’s a perfect example: On March 12, 1928. The St. Francis Dam in San Francisquito Canyon, just outside Los Angeles broke.

The clue that something was wrong? Yeah, that’s right. Water gushing from the very center of the dam wall.

By then it was too late. With a hole that was impossible to plug and billions of gallons of water looking to find its way through – there was nothing to do but try and get out of the way.

Fortunately, you don’t have to wait for price to spring a leak in any given market. You can simply look for cracks in the facade. Thanks to a Volume Spread Analysis, you’re not just looking for cracks – but also for areas of reinforcement.

The detail that’s overlooked by many: The market. And by that, we mean the institutions will tell you what’s going on if you know where to look.

Here’s the scoop on Volume Spread Analysis. It’s a basic view of the relationship between volume and price. You can use it to predict market direction.

More specifically, you’re looking for price levels where volume spikes… or is conspicuously unresponsive. Just imagine an institutional trader sitting at their trading terminal either putting their foot on the gas or sitting on their hands.

The impact of these two institutional reactions is either bullish or bearish.

Make no mistake. If the ‘tourists’ or retail traders, standing on the market’s sidewalk are the ‘easy money’. Then the institutions running the hustle are the ‘smart money’. And they are very aware of who is who in the zoo of any stock, futures or forex instrument.

Check this out: Say the market seems to be going down on your chart. Wouldn’t it be helpful to know if there is little to zero institutional interest in seeing the market go any lower?

Of course! In that environment, it’s likely to stop rising and head back down!

Thanks to volume spread analysis, this is revealed with ‘No Demand’ bars that will start to appear on your chart. Specifically, you’ll see that volume is going down with each bar and the spreads are getting narrower – EVEN THROUGH PRICE IS GOING UP!

A clear indication that the institutions are sitting on their hands! Get ready to sell.

The same applies in the reverse. Say price is going down, but there’s NO institutional pressure to drive it much further down. How can you spot this?

The same way: Selling volume will be going down and the spreads will be getting narrower – EVEN THROUGH PRICE IS GOING DOWN.

These are the advance warnings you need that there’s a break in the dam.

Regardless of whether it’s bullish or bearish, that’s vital intelligence that you (a) need to know and (b) can see directly on your chart!

Chapter 4:

Trade You Can Make For A Lifetime

If you’re scalp trading to make a living, supplement your income or even retire early – then it’s time to leave the pricing shell game alone. Instead of scoffing at the advantage that institutional traders enjoy with all the volume they control –

start profiting from it.

You can do this simply by adding Volume Spread Analysis to your routine when sizing up possible entries.

Here’s the beauty:

- It doesn’t matter what market you trade. You can apply this analysis to stocks, futures or forex.

- Even if you’re new to scalp trading, you can add this to your arsenal effectively in a very short period of time. Forget the players that tell you this takes years.

- You can trade any time-frame you like. That’s right, if you do scalp trading, this will work for you. If you like position swing trades this will work for you. If you’re a long-term trend trader, you can use it effectively.

Consider this for a moment: Do you think for a second that an institutional trader sits at a screen trying to eyeball volume and price activity?

Heck, no. They have tools doing the work for them. Signaling when conditions are perfect for them to be making their entry and exit.

You’ll be relieved to know there’s also a way for you to take the guesswork out analyzing Volume Spreads. In fact, it can be boiled down to three basic indicators, all of which are used by pros to avoid costly and embarrassing mistakes.

You know, the mistakes that result in blind entries and exits? The same ones that torch your account? Yeah… those mistakes.

Better yet, you can identify multiple trades across multiple markets that are exhibiting the very signs of institutional reversals or trends. The very reversals and trends that you’ve likely been seeing after the fact… well after it’s way too late. And certainly, well after the institutional traders have taken their profits.

In order to give yourself a fighting chance for consistent profit, you need the:

- Ability to scan multiple markets for high probability trades.

- Capacity to handle, or at least evaluate multiple trade opportunities.

- Technology to detect institutional market manipulation.

The result? A system of scalp trading and a series of trades you can make for a lifetime. All simply by doing what the pros have been doing for over 100 years.

It’s time to take your losses down to a few dwindling exceptions and your profits up to max capacity.

And guess what? There’s a tool that does all of this for you. Consider it the ‘easy button’ for finding Volume Spread opportunities in any given market.

Set it. Forget it and trade.

Stay tuned for specifics!

Your Next Best Steps:

Step 1:

Step 2: